Cheapest 100 % Equity & Growth Super Options in Australia (2025)

With Australian super fund fees falling rapidly, index-based options from industry funds now rival the lowest-cost ETFs. We’ve compared the main contenders — Hostplus, AustralianSuper, Rest Super, and Vanguard Super — to find which delivers the most international exposure for the lowest all-in cost.

🔍 Comparison Table

| Fund / Option | Strategy | Index Tracked | Intl Equity % | Aust Equity % | Emerging Markets % | Admin Fee (p.a.) | Investment Fee (p.a.) | Total Est. Cost | 5-yr Return (p.a.) | Notes |

|---|---|---|---|---|---|---|---|---|---|---|

| Hostplus Indexed High Growth | ~90-100% shares | Blend of MSCI World ex Aus & ASX 300 | ~70% | ~25% | ~5% | $78 | 0.04% | ~0.09% | ~9.6%* | One of the lowest-cost diversified options in Australia. |

| Hostplus International Shares – Indexed | 100% intl shares | MSCI World ex Australia NR (AUD) | 100% | 0% | small EM tilt | $78 | 0.07% | ~0.12% | ~14.3% | Pure international equity exposure. |

| AustralianSuper Indexed Diversified | ~85% shares | MSCI World ex Aus + ASX 300 | ~60% | ~25% | ~5% | $78 | 0.06% | ~0.11% | ~9.5% | Very similar cost profile to Hostplus Indexed. |

| Rest Indexed Growth | ~85% shares | ASX 300 + MSCI World ex Aus | ~60% | ~25% | ~5% | $78 | 0.08% | ~0.13% | ~9.4% | Low-cost, fewer published multi-year figures. |

| Vanguard Super Growth | ~90% shares | Vanguard Global Index (Dev + EM) | ~70% | ~20% | ~10% | $78 | 0.33% | ~0.38% | ~10.1%† | Broader coverage including emerging markets; higher cost. |

* Uses Hostplus Indexed Balanced as proxy for the newer High Growth series

† Benchmark performance before admin fee

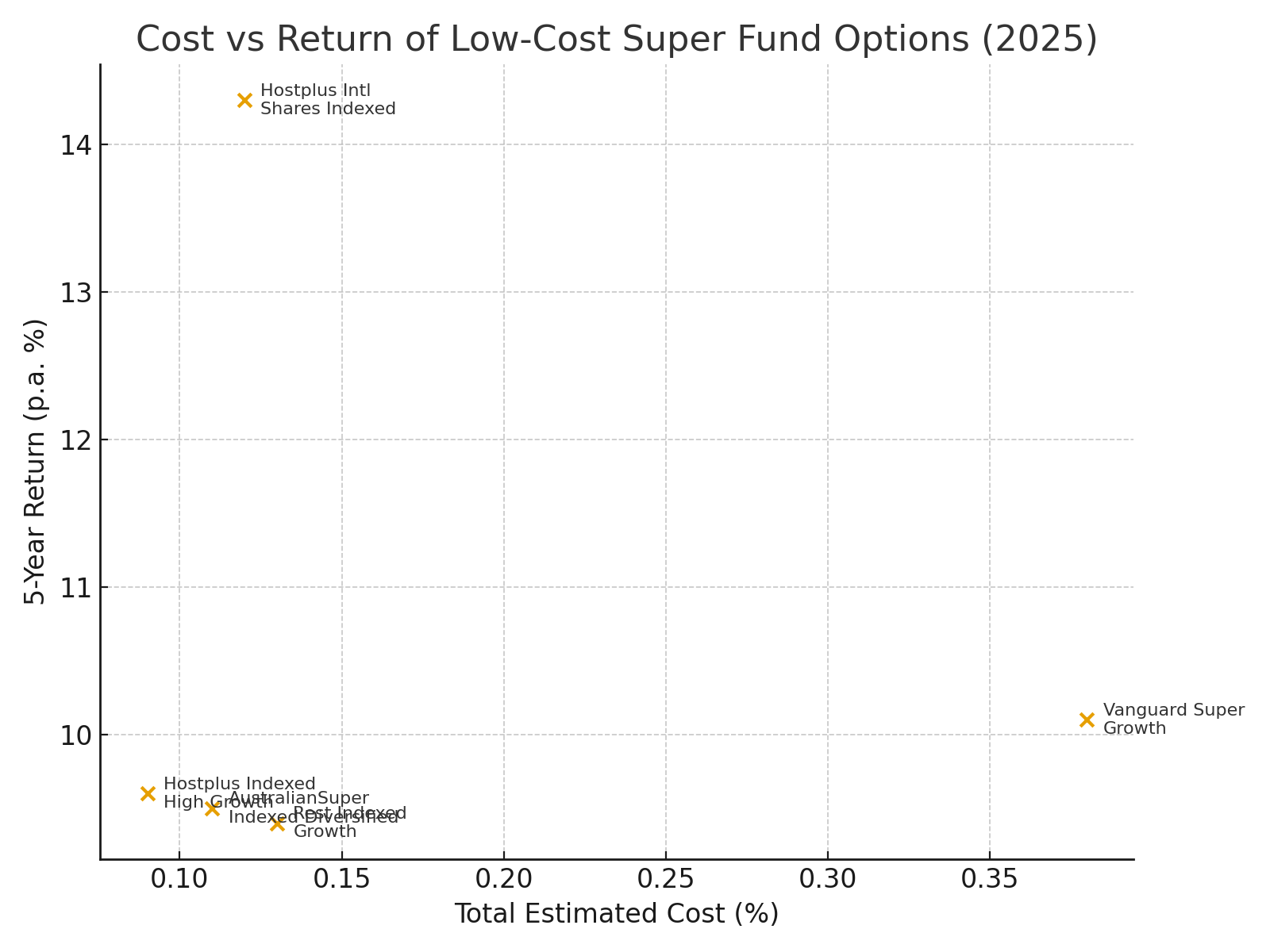

📊 Chart 1: Cost vs Return

- The lowest-cost funds are clustered at left-bottom cost, yet deliver solid returns.

- Higher cost funds (like Vanguard) deliver slightly better returns but with a cost penalty.

- The standout performer is the Hostplus International Shares Indexed which has had a ripper few years helped by the Magnificent Seven. Which just shows why you should invest outside Australia

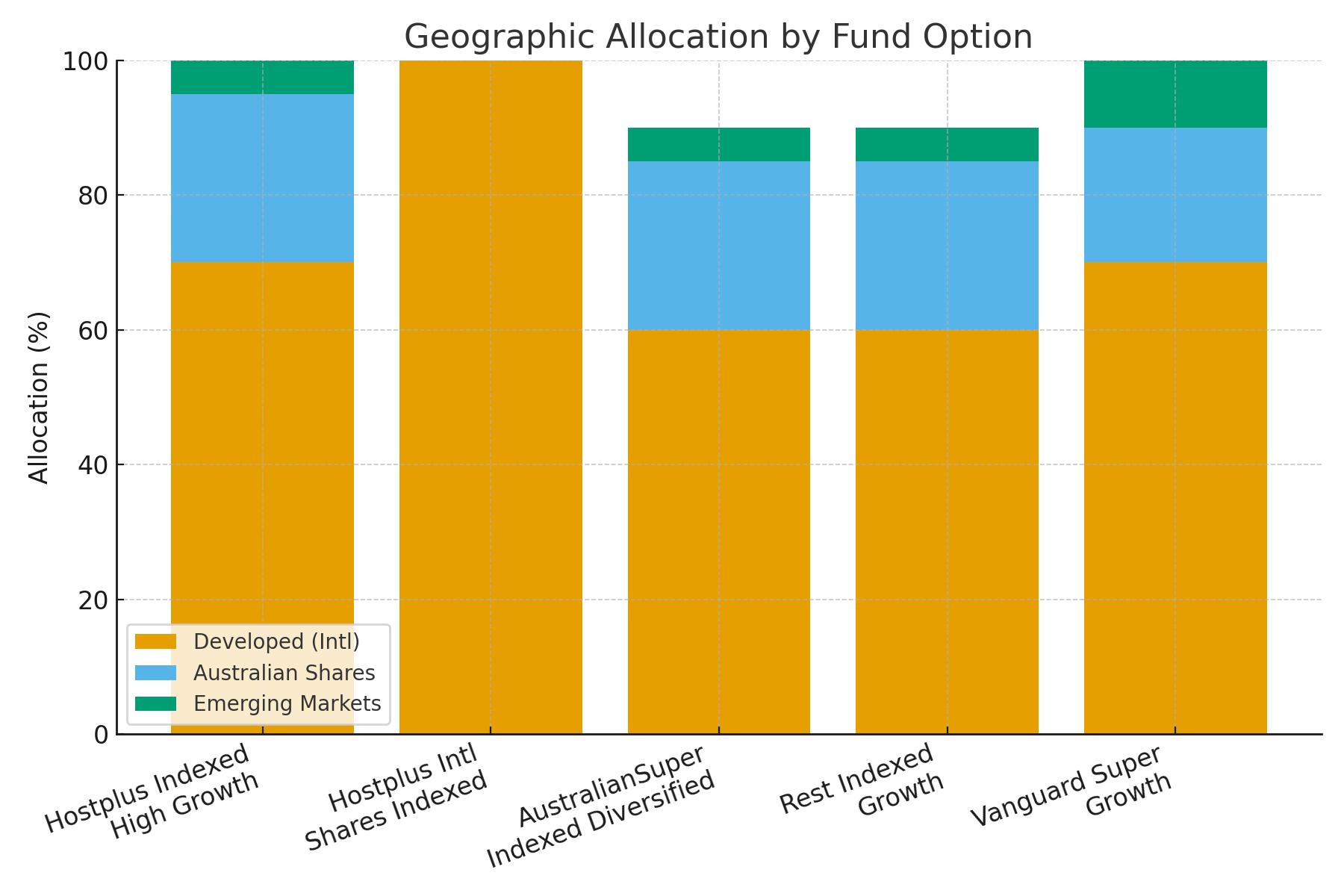

📊 Chart 2: Geographic / Diversification Exposure

- Hostplus International Shares – Indexed offers 100% international equity (0% Australian).

- Vanguard includes ~10% emerging markets exposure.

- Rest and AustralianSuper have a stronger Australian equity component (~25%) than the pure international options.

🧩 Key Insights

- Hostplus Indexed series remain the fee leaders: total annual costs under ~0.10% to 0.12% plus the $78 admin fee.

- AustralianSuper and Rest Indexed options are very close behind in cost and offer broad diversification.

- Vanguard Super Growth costs around triple (~0.38%) yet offers ~10% emerging markets exposure — a valid trade-off for broader diversification.

- Emerging markets exposure: only Vanguard openly includes ~10% EM in the mix; others rely heavily on developed markets.

- All five funds are passively managed / index-based (for the options listed) and regularly rebalance – making them suitable for “set and forget” growth-oriented portfolios.

🪙 Best-Value Picks

| Goal | Recommended Option | Why |

|---|---|---|

| Lowest total cost | Hostplus Indexed High Growth | 0.04% investment fee + $78 admin; simple index mix. |

| Pure international equities | Hostplus International Shares – Indexed | Tracks MSCI World ex Australia NR at 0.07%. |

| Broader diversification including emerging markets | Vanguard Super Growth | Slightly higher cost, but adds ~10% emerging markets. |

| Balanced high-growth with low cost | AustralianSuper Indexed Diversified | Cheap, large scale, highly rated. |

⚖️ Final Takeaway

If your goal is to maximise long-term returns through low fees, Hostplus’s indexed range currently delivers the best value in the Australian super market.

For those seeking global diversification including emerging markets, Vanguard Super presents a solid premium option.

Meanwhile, AustralianSuper and Rest provide very competitive alternatives with slightly higher cost but large scale and strong governance.

References

- Hostplus investment performance to 30 June 2025.

- AustralianSuper Balanced returns to 30 June 2025.

- SuperGuide sector return summaries (emerging vs developed).

- Fund fee and cost disclosures from Hostplus, AustralianSuper and Vanguard Super PDS/Dashboards.