Don't die owning UK shares. The sneaky inheritance tax trap hiding in UK-domiciled assets

Don't die owning UK shares. The sneaky inheritance tax trap hiding in UK-domiciled assets

Most people think UK inheritance tax (IHT) is something you only need to worry about if:

- You live in the UK

- You own a house in the UK

- You plan to die dramatically in a top hat somewhere in Surrey

Unfortunately, the UK tax system is far more devious than that.

You can be living happily overseas — Australia, Europe, Mars — and still leave your family with a 40% UK inheritance tax bill purely because of what you own, not where you live.

Let’s talk about UK-sited assets, why they matter, and how to quietly avoid this mess altogether.

What actually triggers UK inheritance tax?

Here’s the key idea most people miss:

UK inheritance tax is based on asset location (situs), not where the owner lives or where the broker is.

So:

- Living overseas ❌ not enough

- Holding assets in a non-UK broker ❌ not enough

- Being an Australian citizen ❌ still not enough

If the asset itself is UK-sited, HMRC still wants a slice.

And that slice is 40% above £325,000. Ouch.

What counts as a UK-sited asset?

This is where things get sneaky.

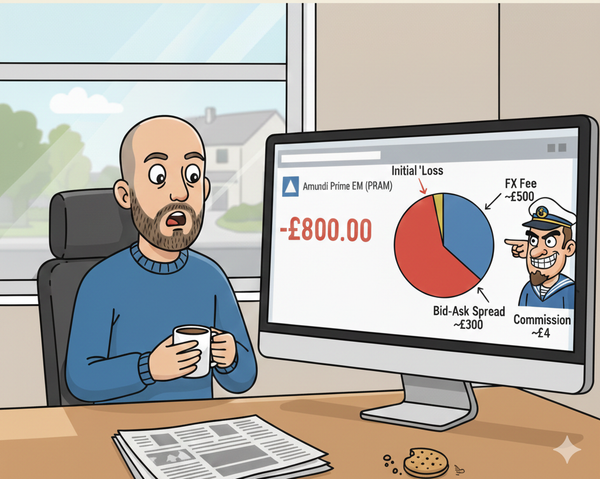

1. UK-domiciled funds and ETFs (the silent killer)

These are the biggest trap I see.

If a fund or ETF is domiciled in the UK, it is a UK-sited asset — regardless of:

- Where you live

- What currency it trades in

- Which exchange it’s listed on

Examples of UK-sited investments:

- UK-domiciled ETFs

- UK OEICs and unit trusts

- Funds run by UK managers domiciled in the UK

If you die holding these and you’re over the IHT threshold, HMRC rubs its hands together.

2. Shares in UK companies

If the company is incorporated in the UK, the shares are UK-sited.

Examples:

- FTSE 100 companies

- UK-listed small caps

- Shares held through any broker, anywhere in the world

It doesn’t matter if:

- The broker is Australian

- The shares are held electronically

- You haven’t lived in the UK for decades

UK company = UK-sited asset.

3. UK property (no surprises here)

- Residential

- Commercial

- Buy-to-let

- Your “we might move back one day” house

All firmly inside the UK IHT net.

4. Cash in UK bank accounts

Yes, really.

Large balances sitting in UK accounts are UK-sited and can be pulled into IHT calculations.

What doesn’t count as UK-sited?

Now for the good news.

1. Irish-domiciled ETFs (the MVP)

These are absolute gold for non-UK investors.

Examples:

- Vanguard ETFs domiciled in Ireland

- iShares UCITS ETFs domiciled in Ireland or Luxembourg

Even if:

- They trade on the London Stock Exchange

- They’re priced in GBP

- You hold them with a UK broker

➡️ Not UK-sited ➡️ Outside UK inheritance tax

This is why so many sensible people quietly hold Irish-domiciled funds instead of UK ones.

2. US-listed shares and ETFs

For non-UK residents:

- US shares ≠ UK-sited

- US ETFs ≠ UK-sited

(You may have US estate tax issues instead — that’s a separate horror movie.)

From a UK perspective, HMRC has no claim here.

3. Non-UK property

Australian property, European property, moon bases — not UK-sited.

The “but it’s held in a UK brokerage” myth

This one causes endless confusion.

Holding assets in:

- Hargreaves Lansdown

- Interactive Investor

- AJ Bell

does not automatically make them UK-sited.

The broker location is largely irrelevant. The asset domicile is what matters.

This is how people accidentally do everything right… or everything very wrong.

How people accidentally create a £200k+ tax problem

Here’s a classic scenario:

- You move overseas

- You sensibly invest in ETFs

- You pick a UK-domiciled ETF because it’s familiar

- You forget about it for 20 years

- You die

- HMRC sends a thank-you note to your estate

Boom. 40% tax bill your family didn’t see coming.

How to avoid this completely (legally and boringly)

The fix is wonderfully dull:

✅ Own only non-UK-sited assets

That usually means:

- Irish- or Luxembourg-domiciled ETFs

- US-listed shares

- Non-UK property

- Avoid UK-domiciled funds entirely

Check domicile, not:

- Exchange

- Currency

- Marketing brochure vibes

If the fund factsheet says “Domicile: Ireland” — you’re smiling.

A simple rule of thumb

If you live outside the UK long term:

- ❌ UK-domiciled funds

- ❌ UK company shares

- ❌ UK property you don’t need

- ✅ Irish-domiciled ETFs

- ✅ US or global shares

- ✅ Assets clearly outside the UK tax net

This one decision can save your heirs hundreds of thousands.

Final thoughts

UK inheritance tax is not evil — it’s just extremely polite about not warning you.

No letters. No alerts. No helpful pop-ups saying “by the way, this ETF will nuke your estate”.

So you have to be the boring, spreadsheet-loving adult in the room.

Your future family will thank you. Probably quietly. Possibly with wine.