ETF Buyers Checklist (UK)

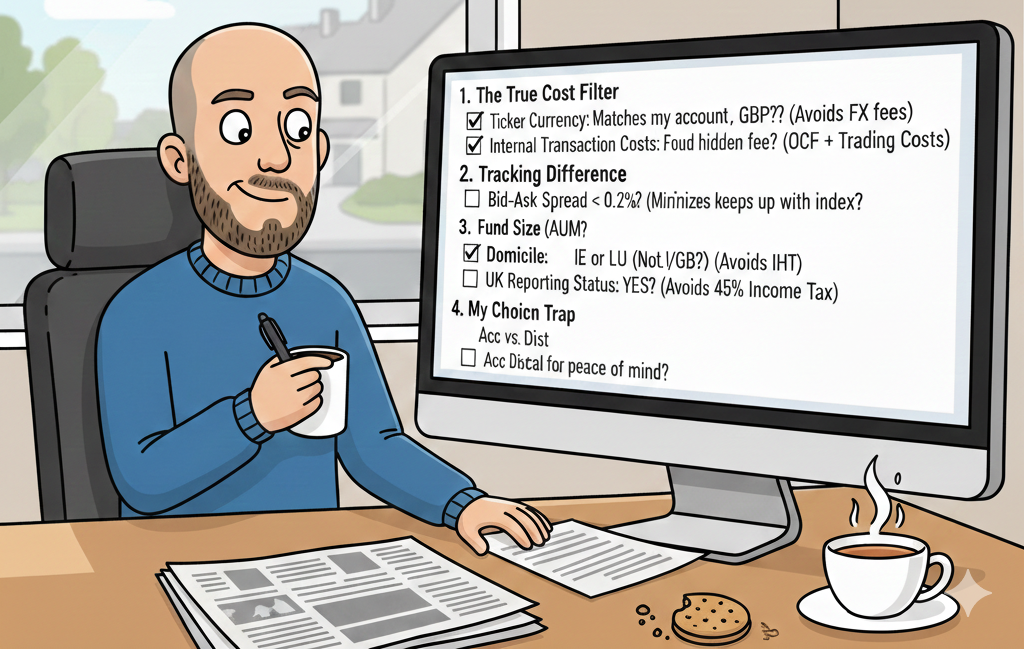

There are some very important considerations in choosing an ETF to buy that are totally in your control. This post explains why you should know about transaction costs, FX fees, Domincile and reporting status to name but a few.

In investing, as in life, you should only worry about the variables you can control. Once you’ve selected an index, the market's performance is up to, well the market. However, the way you buy that index is entirely up to you. There are a handful of 'gotchas' in the ETF world that, if missed, allow your broker or the taxman to feast on your hard-earned capital before you’ve even started.

To show you what I mean, let’s look at two investors, "Hasty Harry" and "Checklist Charlie." Both have £100,000 to invest in the exact same Emerging Markets fund.

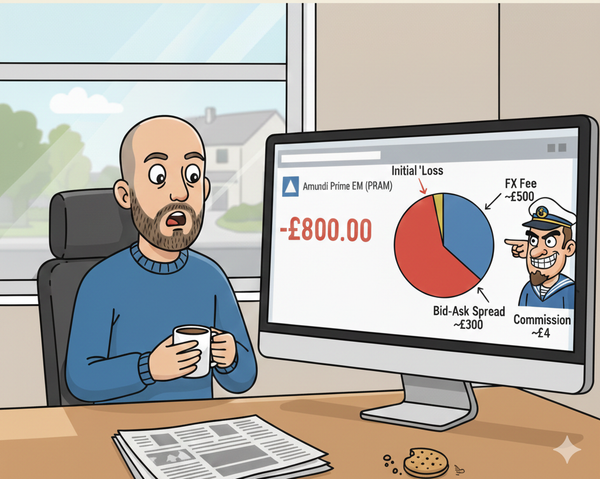

The fund I’ve used for illustration purposes is the Amundi Prime Emerging Markets ETF

The Tale of Two Trades: £100,000 Investment

The Result on Day 1

- Hasty Harry looks at his screen and sees £98,896. He has lost £1,104 before the market has even moved a single inch. He’s also sitting on a tax time bomb that could eventually cost his family 45% of his profits or 40% of his total wealth.

- Checklist Charlie looks at his screen and sees £99,796. He’s only "down" £204 (mostly just the unavoidable bid-ask spread). He sleeps soundly knowing his tax bill is minimized.

Why the "Everything Wrong" Way is so common

The reason Harry messed up isn't that he's a bad investor; it's that brokers make it easy to mess up. They’ll happily let you buy a USD ticker with a GBP account because that FX fee is pure profit for them. They won't warn you about "Reporting Status" because they aren't tax advisors.

My Personal Takeaway

The "Checklist Way" isn't about being a genius; it's about being a bit of a pedant. Before I click that "Buy" button now, I ask myself three questions:

- Is the ticker in my local currency? (Avoid the FX gut-punch).

- Is it a "Reporting Fund"? (Avoid the 45% Income Tax trap).

- Is the market fully "awake"? (Avoid the wide morning spreads).

Spending five minutes running these checks is the easiest way to "earn" £1,000 you’ll ever find.