The Case of the Vanishing £800: Why Your New Investment Just Slapped You in the Face

The Case of the Vanishing £800: Why Your New Investment Just Slapped You in the Face

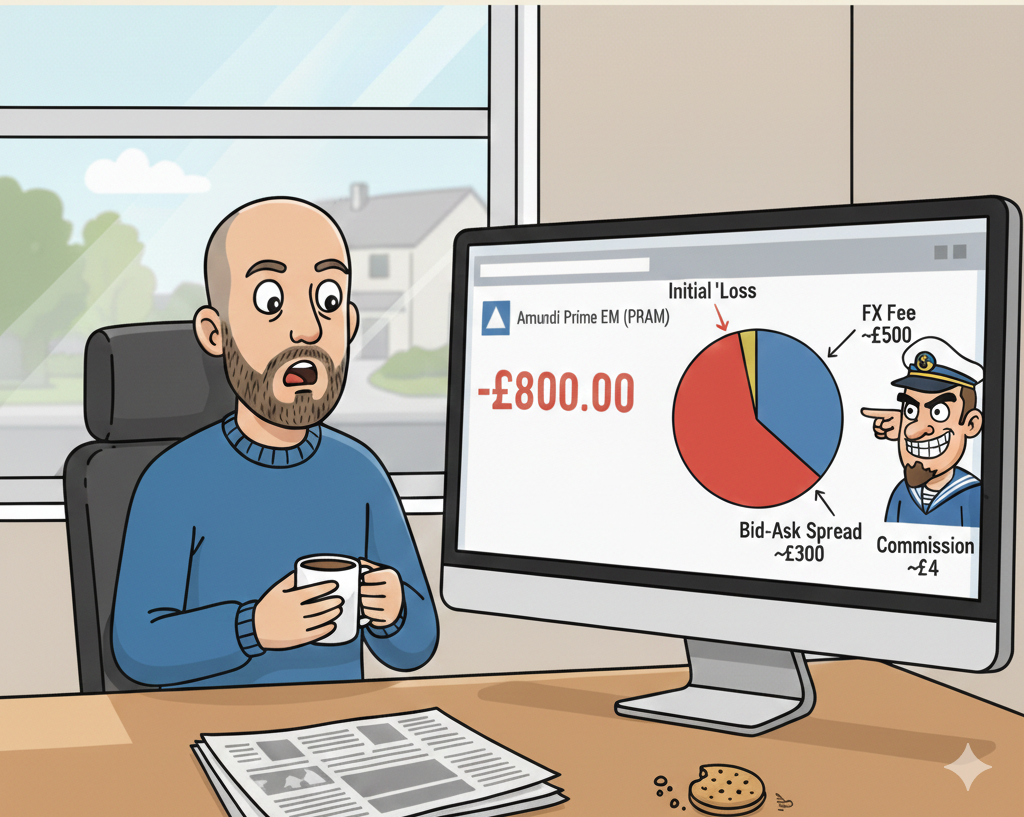

So, you’ve finally done it. You’ve saved up a crisp £100,000, done your homework, and decided to tuck it away in the Amundi Prime EM fund. You hit the big shiny "Buy" button on Interactive Investor, only to look at your dashboard ten seconds later and see your balance is now £99,200.

Wait. What?

You haven't even had time to make a cup of tea, and the market has apparently decided to mug you for £800. Before you start frantically emailing customer support or assuming the global economy has collapsed in the last thirty seconds, take a deep breath. You’ve just experienced a classic "Welcome to the Market" moment.

Here’s where your money went, and why—in this case—the "P" in PRAM might as well stand for "Please take my money."

1. The FX Tax (The £500 Gut Punch)

This is the big one. If you bought the ticker PRAM, you bought the version of the fund priced in US Dollars. But your account is in British Pounds.

Interactive Investor (ii) looks at that and thinks, "Ooh, a currency conversion! Don't mind if I do." On a £100k trade, they charge 0.75% on the first £50k and 0.25% on the rest.

- The Maths: £375 + £125 = £500.

That £500 didn't vanish into the markets; it went straight into the broker's "New Yacht Fund." If you had bought PRAN (the GBP version), this fee would have been zero. That’s right. A five-second difference in which ticker you typed could have saved you enough for a very nice weekend away.

2. The "Spread" (The £300 Invisible Hand)

Even if you avoid the FX fee, you’ll always face the Bid-Ask Spread.

Think of it like a dodgy bureau de change at the airport. They sell you Euros at one price and buy them back at a much worse one. Stocks work the same way. You bought at the "Ask" price (the high one), but your broker displays your portfolio value at the "Bid" price (the price you'd get if you sold it right now).

Because Emerging Markets involve stocks in far-flung places like Taiwan and Brazil, the gap between these two prices is wider than for, say, Apple or Shell. A 0.3% spread on £100k is £300. It’s not a "real" loss unless you sell immediately, but it sure looks ugly on the screen.

3. The "Everything Else"

Then you’ve got the actual trading commission (about £4 at ii) and the fact that the "Gain/Loss" column usually includes all your entry costs from Day 1. It’s like buying a new car and realizing it’s worth 10% less the moment you drive it off the forecourt.

How to avoid the "Insta-Loss" next time:

If you’re a UK investor using Pounds, always look for the GBP ticker. * PRAM = US Dollars (Broker goes ka-ching on FX fees)

- PRAN = British Pounds (Broker stays hungry)

The underlying "guts" of the fund are identical. They both hold the same Samsung and TSMC shares. The only difference is whether you pay your broker a massive tip for the privilege of converting your cash.

See FX fees on investments: how to crush them on Monevator for strategies on how to avoid these hidden FX fees.

The Moral of the Story: In the world of investing, the "boring" details like tickers and currency denominations are where the real money is saved. You’re not down because the Chinese tech sector tanked; you’re down because you accidentally bought the "International Tourist" version of the fund.

Live, learn, and next time, check the ticker twice!